Notice Regarding Decision of Issuance Terms of Executive Compensation-Type Stock Options (Stock Acquisition Rights)

-FOR IMMEDIATE RELEASE- Click here for PDF

SEPTENI hereby provides notice that of the specific content of stock acquisition rights that will be issued as executive compensation-type stock options as decided at a Board of Directors meeting on January 26, 2016, the amount to be paid, which was undecided, has now been decided. Details are as follows.

1.Date of allocation of the stock acquisition rights

February 17, 2016

2.Number of stock acquisition rights to be issued

327 acquisition rights(Number of shares per stock acquisition right:100 shares)

3.Type and number of shares under the stock acquisition rights

32,700 shares of common stock of SEPTENI

4.Amount to be paid for the stock acquisition rights

179,800 yen per stock acquisition right (1,798 yen per share) (Note)

However, as directors and auditors to receive the allocation will balance this amount out against the remuneration rights to SEPTENI, no payment amount shall arise for the stock acquisition rights.

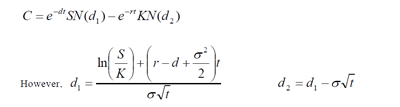

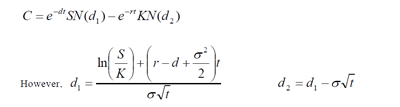

(Note) This is an amount that was obtained by multiplying the option price per share that was calculated from the basic values from (2) to (7) below based on the Black-Sholes model in the following formula by the number of shares to be granted.

(1) Option price per share (C)

(2) Stock price at the time of calculation (S):

The closing price of the common stock of SEPTENI in the regular transaction on the Tokyo StockExchange on February 17, 2016.

(3) Exercise price (K):7 yen

(4)Expected remaining period (t):One year

(5)Volatility (σ):

Stock price volatility that is calculated based on the closing prices of the common stock of SEPTENI on the last trading day in the regular transaction in each week from March 4, 2015 to February 17, 2016.

(6) Risk-free interest rate (r):

Interest rate of the government bond with the remaining life that corresponds to the expected remaining period.

(7)Dividend yield (d):

Dividend per share (actual dividend in the fiscal year ended September 2015) ÷The stock price

specified in (2) above

(8) Probability density function (N(.))

*The amount to be paid that is calculated from the above is a fair value.

SEPTENI hereby provides notice that of the specific content of stock acquisition rights that will be issued as executive compensation-type stock options as decided at a Board of Directors meeting on January 26, 2016, the amount to be paid, which was undecided, has now been decided. Details are as follows.

1.Date of allocation of the stock acquisition rights

February 17, 2016

2.Number of stock acquisition rights to be issued

327 acquisition rights(Number of shares per stock acquisition right:100 shares)

3.Type and number of shares under the stock acquisition rights

32,700 shares of common stock of SEPTENI

4.Amount to be paid for the stock acquisition rights

179,800 yen per stock acquisition right (1,798 yen per share) (Note)

However, as directors and auditors to receive the allocation will balance this amount out against the remuneration rights to SEPTENI, no payment amount shall arise for the stock acquisition rights.

(Note) This is an amount that was obtained by multiplying the option price per share that was calculated from the basic values from (2) to (7) below based on the Black-Sholes model in the following formula by the number of shares to be granted.

(1) Option price per share (C)

(2) Stock price at the time of calculation (S):

The closing price of the common stock of SEPTENI in the regular transaction on the Tokyo StockExchange on February 17, 2016.

(3) Exercise price (K):7 yen

(4)Expected remaining period (t):One year

(5)Volatility (σ):

Stock price volatility that is calculated based on the closing prices of the common stock of SEPTENI on the last trading day in the regular transaction in each week from March 4, 2015 to February 17, 2016.

(6) Risk-free interest rate (r):

Interest rate of the government bond with the remaining life that corresponds to the expected remaining period.

(7)Dividend yield (d):

Dividend per share (actual dividend in the fiscal year ended September 2015) ÷The stock price

specified in (2) above

(8) Probability density function (N(.))

*The amount to be paid that is calculated from the above is a fair value.